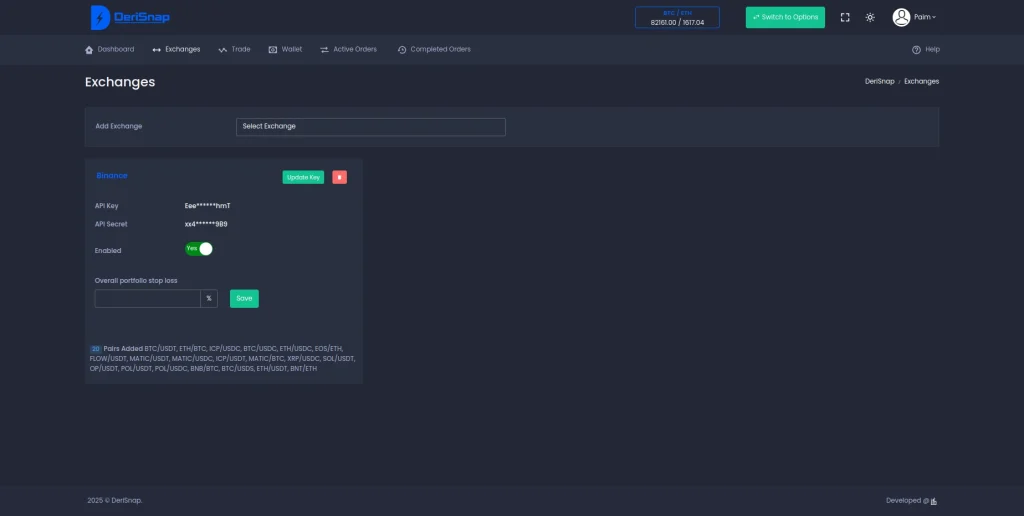

Connect one or more exchange accounts to get started.

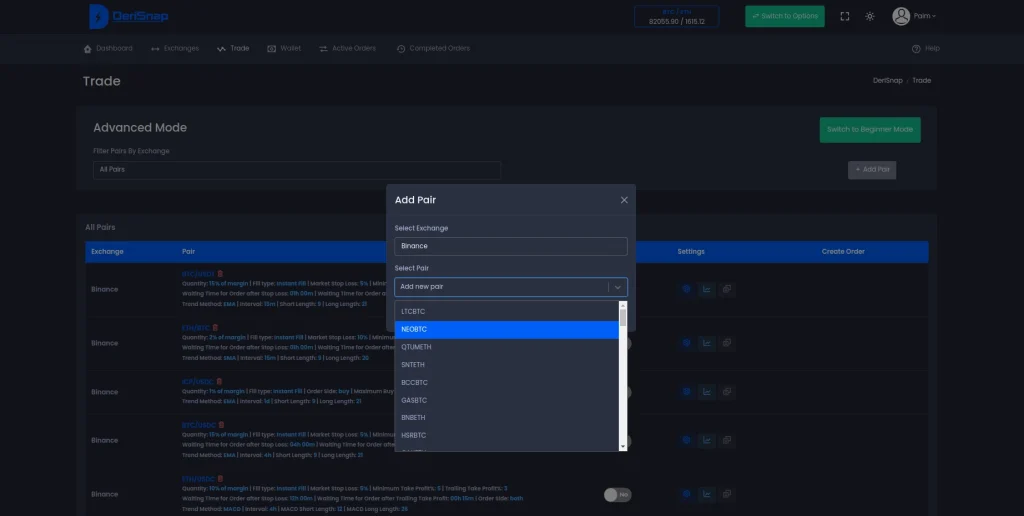

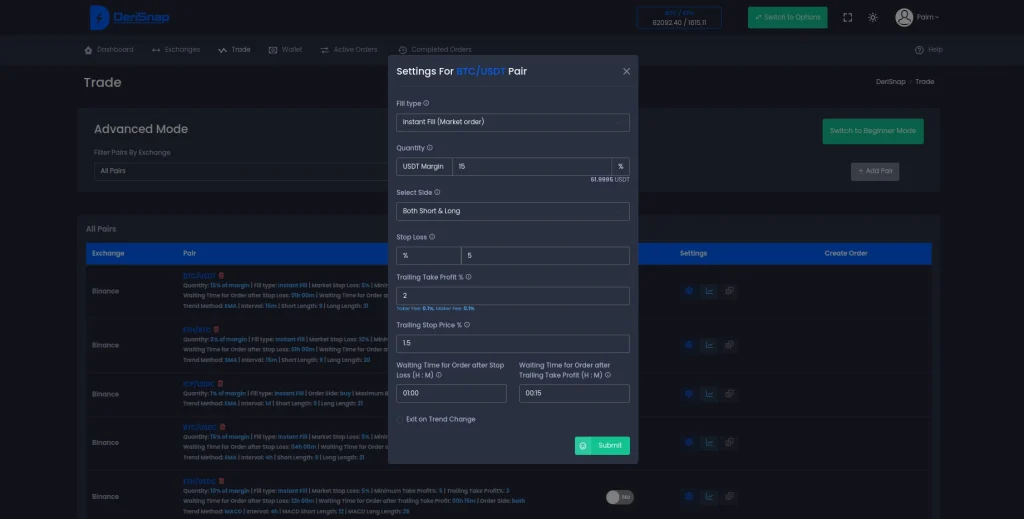

Pick the coins you want to trade, set your trend preferences, and turn on smart features like stop loss, trailing profit, and Exit on trend change to stay on top of market moves—even when you’re away.

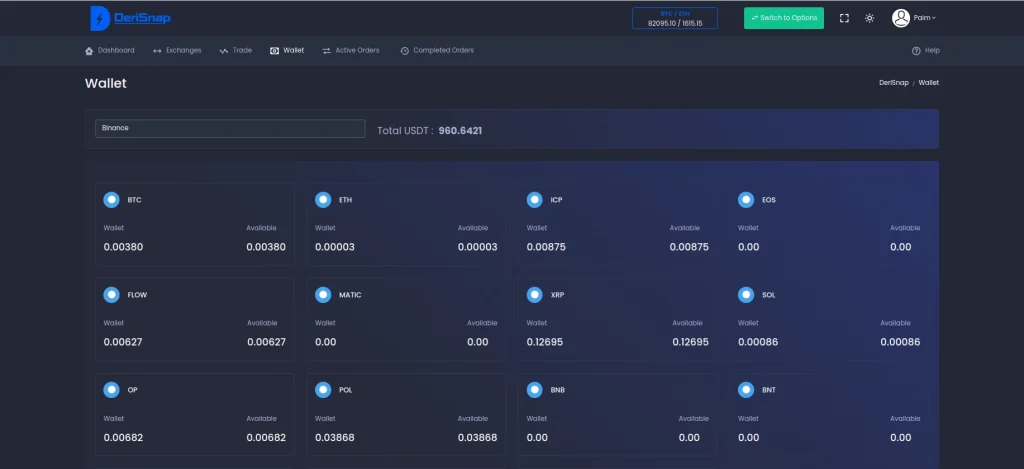

Monitor your wallet balances in real time.

Get real-time updates on your assets across exchanges, giving you full visibility and control over your crypto portfolio.

Track your active orders live, along with real-time PNL updates.

Gain full visibility into your open positions across connected exchanges. The platform continuously updates your active orders and provides real-time profit and loss (PNL) data, helping you make informed decisions quickly and efficiently.

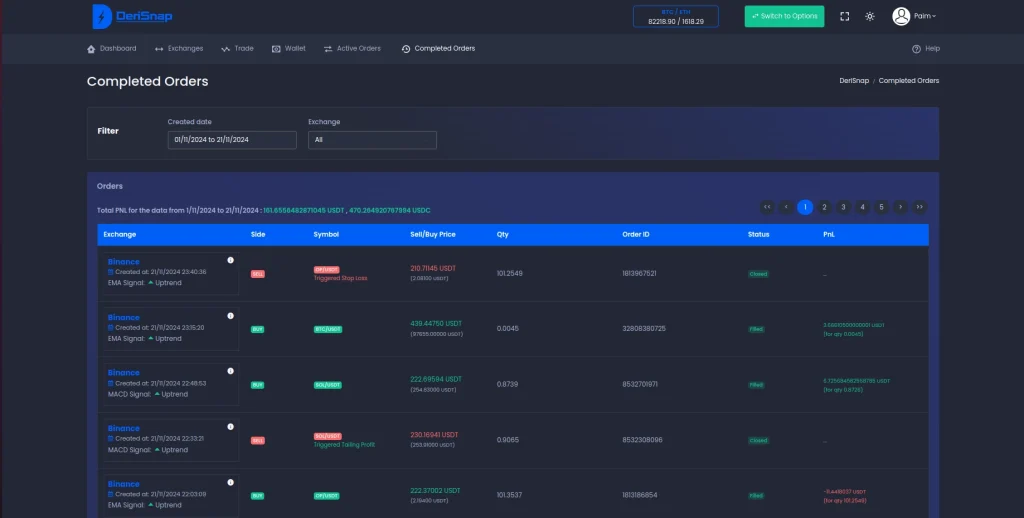

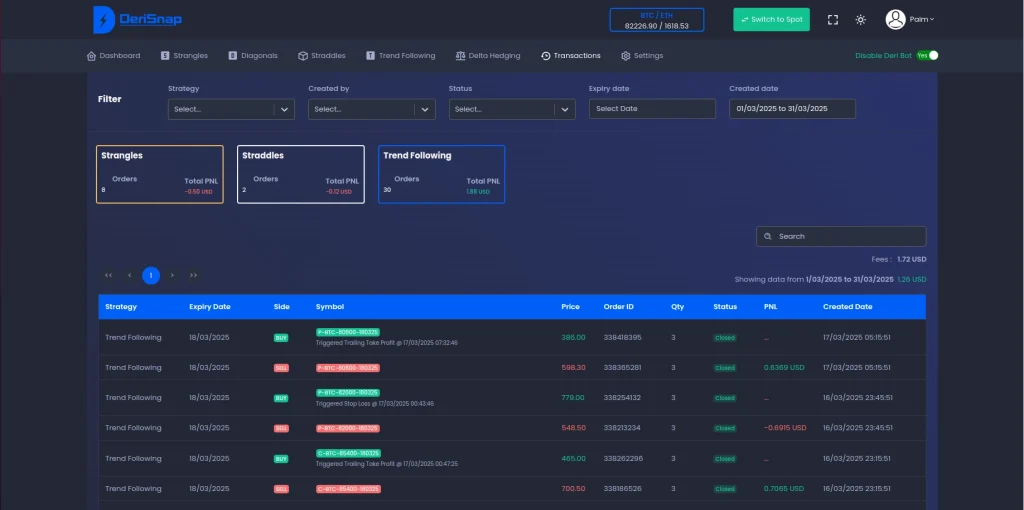

View your completed orders on the dedicated Completed Orders page, along with PNL summaries.

Easily review all your past trades with detailed profit and loss (PNL) calculations. The Completed Orders page provides a clear overview of your trading history, helping you analyse performance and track results over time.

Access detailed PNL analytics for all your trades across all exchanges—or filter by a specific exchange.

Review your trading performance over the past six months with comprehensive profit and loss insights. Whether you want a broad overview or a deep dive into a single exchange, the analytics tools help you evaluate trends, optimise strategies, and make data-driven decisions.

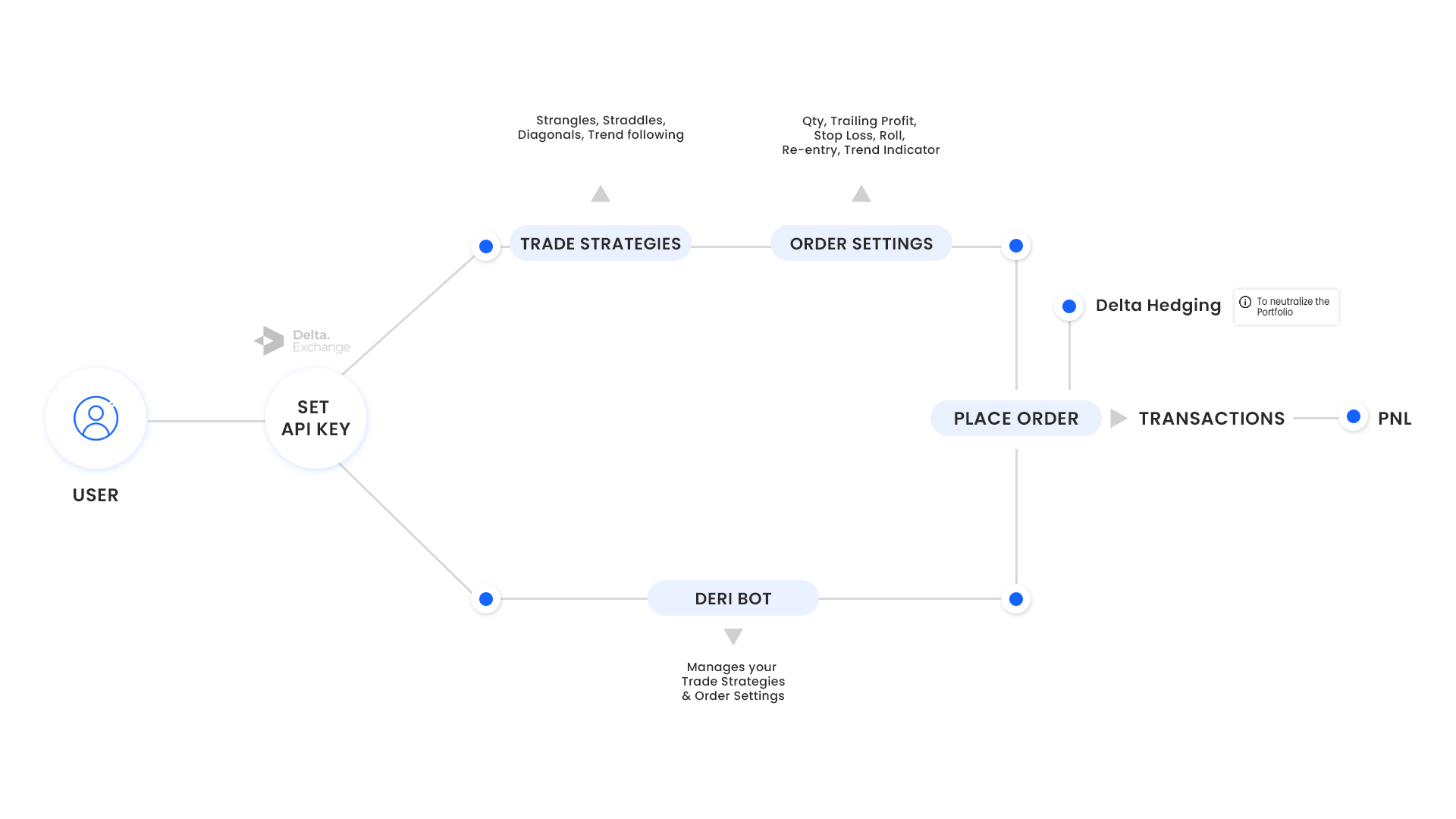

Options Trading

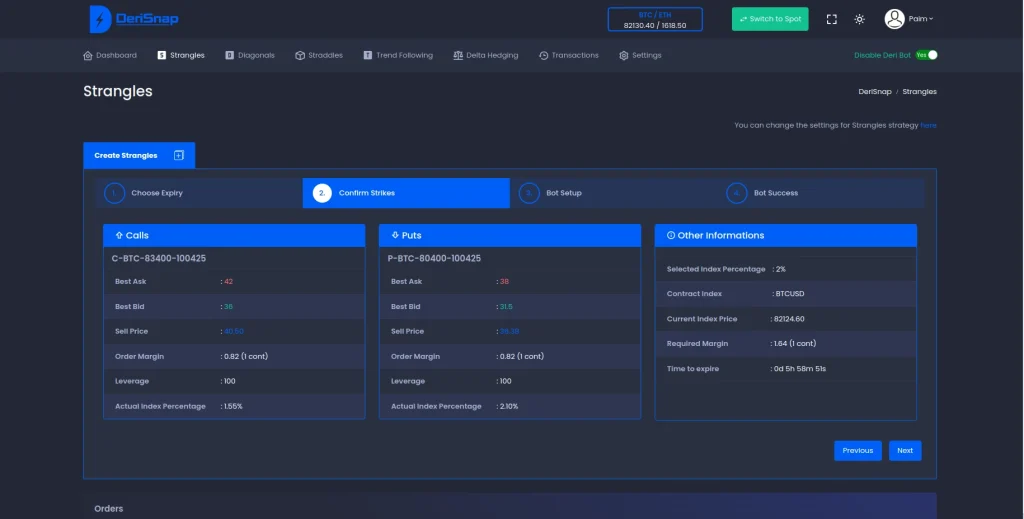

Updating Delta Exchange Keys and Initiating a Strangles Order

Execute a trade with a diagonal spread

Initiate a trade based on trend signal

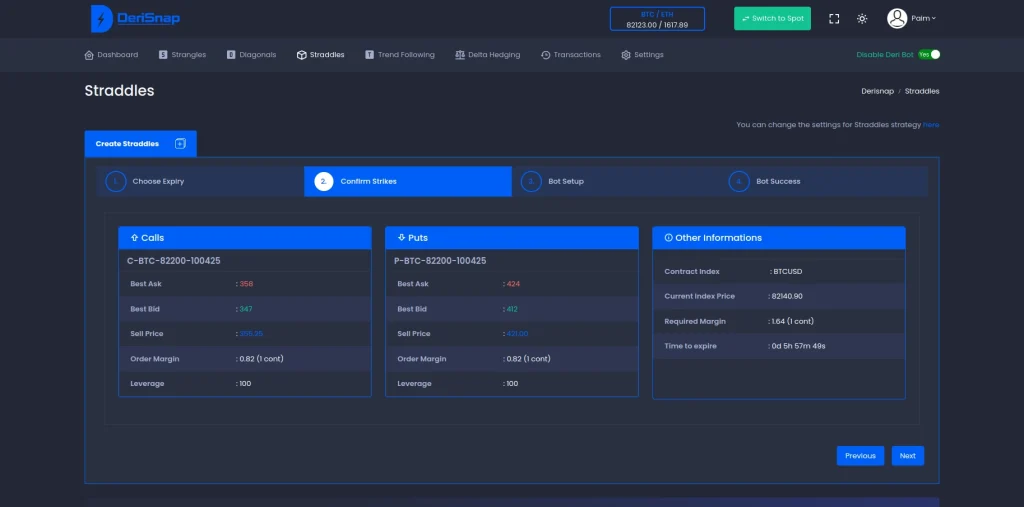

Take a position using a straddle approach

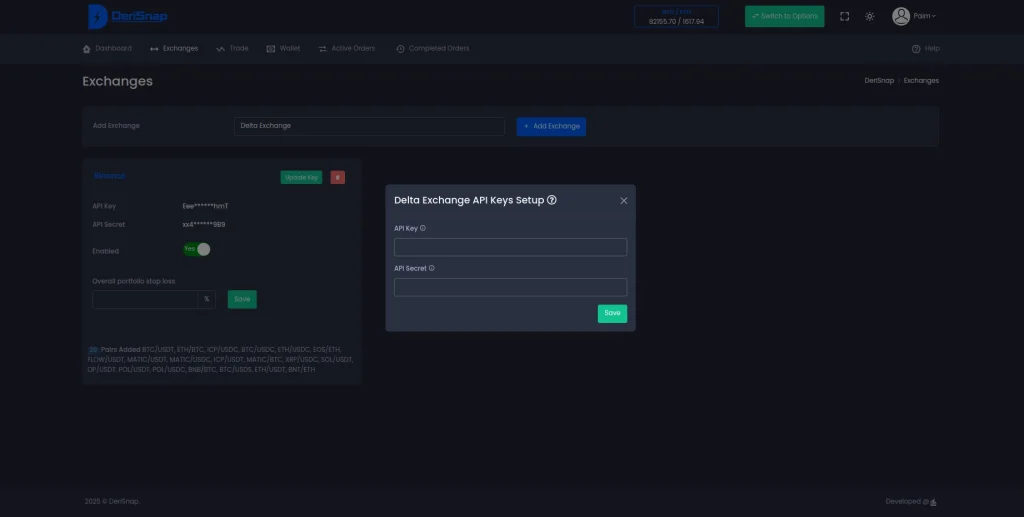

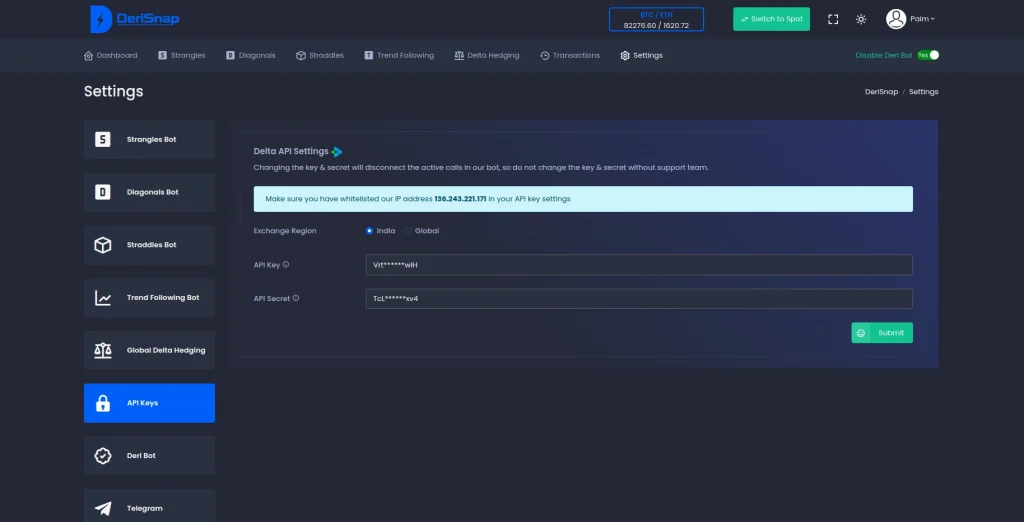

Connect your Delta Exchange account to get started.

Once you link your Delta Exchange account, you’ll be all set to dive into options trading. Get real-time updates and manage your trades easily, all in one place.

Trade using advanced strategies such as Strangles, Straddles, Diagonals, and Trend Following, with the option to enable Delta Hedging to neutralize your margin risk.

These powerful strategies provide flexibility to capitalise on various market conditi

ons. Whether you’re managing volatility with Strangles or Straddles, adjusting positions with Diagonals, or following trends, you can optimise your risk-reward profile. Enabling Delta Hedging further protects your margin by reducing directional exposure, offering a more balanced and secure trading experience.

Maximize your Strangles trades with advanced settings like Trailing Profit, Stop Loss, Reentry, and Roll. Lock in profits with trailing profit and protect your capital with stop loss while easily re-entering positions when market conditions align. The Roll settings allow you to automatically adjust strike prices based on a specified distance from the index, trigger rolls after a set delay, and set premium price ranges to execute new orders when the conditions are met, ensuring efficient and flexible trade management.

Diagonals involve trading options on the same side with either the same or different strike prices and different expiration dates, with settings for instant fills, profit targets, and specific market timings.

A Straddle strategy involves buying both a call and a put option at the same strike price and expiration date, positioned on the same side of the market. This strategy profits from significant price movements in either direction, regardless of the market’s direction. By adding Trailing Stop Loss and Trailing Profit settings, you can automatically lock in profits as the market moves in your favor and limit losses if the market moves against you. These settings adjust dynamically, providing an additional layer of risk management and ensuring your trades are optimized in volatile market conditions.

Trend Following strategy leverages a range of trend indicators, including SMA, EMA, MACD, and Super Trend, to identify market direction. It offers customizable settings such as timeframes, trailing stop loss, and trailing take profit, designed to secure profits and minimize losses within specified percentage thresholds. The strategy further includes controls for re-entry, wait times, and intervals between orders to optimize trade timing and prevent premature entries. Additionally, it ensures that positions and orders are automatically closed when a trend change or reversal occurs, aligning the strategy with the market’s prevailing direction while maintaining effective risk management.

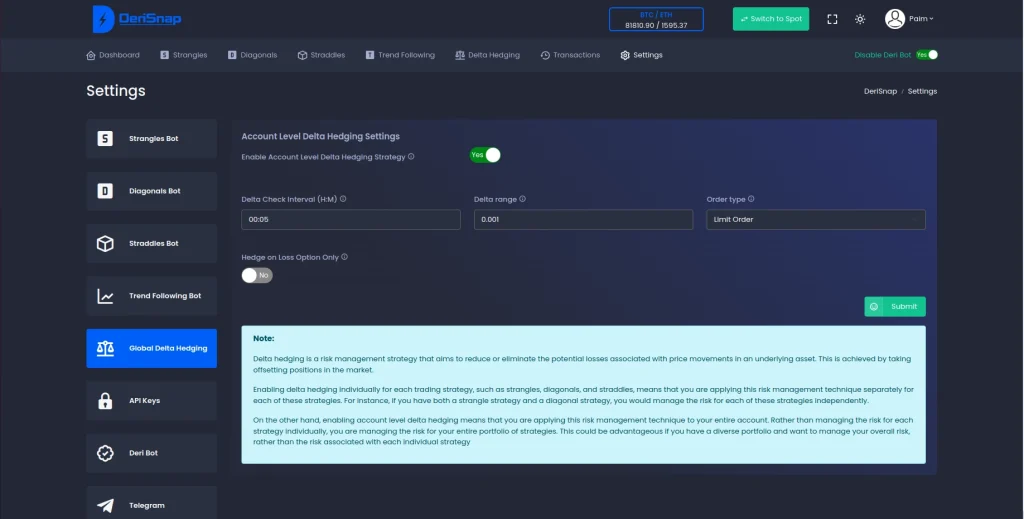

Delta Hedging neutralizes price movement risks by adjusting positions to maintain a neutral delta. At the account level, it adjusts the entire portfolio to stay neutral to market fluctuations. For a strategy-based approach, delta hedging is applied to individual strategies. However, if enabled at the global level, it overrides strategy-based hedging, applying to the entire account instead. This ensures stable account value and consistent risk management amid market volatility.

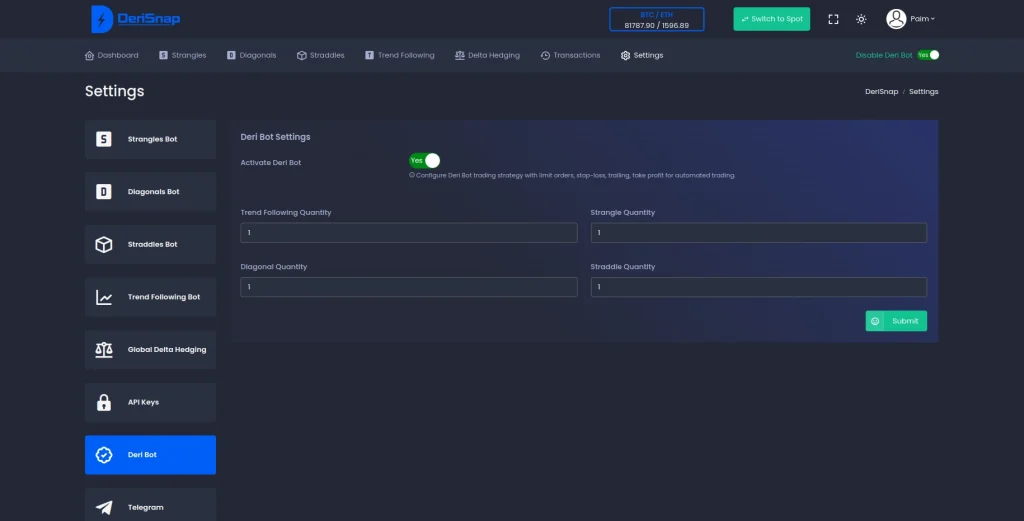

Deri Bot automatically executes trades for you once enabled, with the user being able to set the quantity for each strategy. All other settings, such as strike preferences, trailing stop loss, and other risk management features, are handled by the bot, ensuring the seamless execution of your trades without requiring manual adjustments. This allows you to focus on the broader strategy while the bot takes care of the detailed settings and adjustments based on market conditions.