Your gateway to intelligent trading.

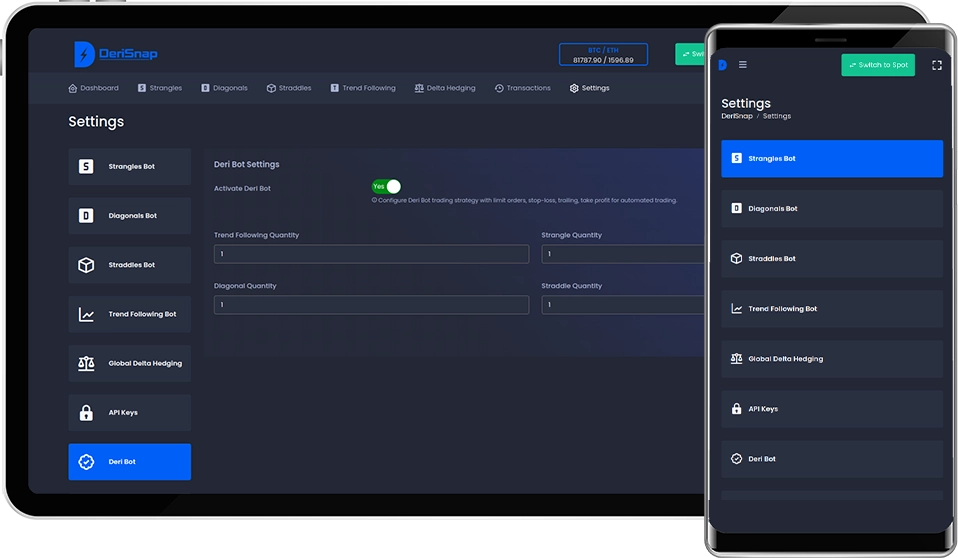

We specialise in derivative strategies like straddle, strangle, trend following, and delta hedging as well as cash / futures trading.

Our platform also enables seamless spot trading across multiple crypto exchanges.

Use our predefined strategies or create your own – full control, your way!